Optimise Commercial Insurance Operations with

Agiliux for Insurers

Agiliux helps P&C insurers replace outdated manual processes with digital, standards-based data exchange. Improve collaboration with brokers and reinsurers, and streamline commercial insurance operations for greater efficiency and accuracy.

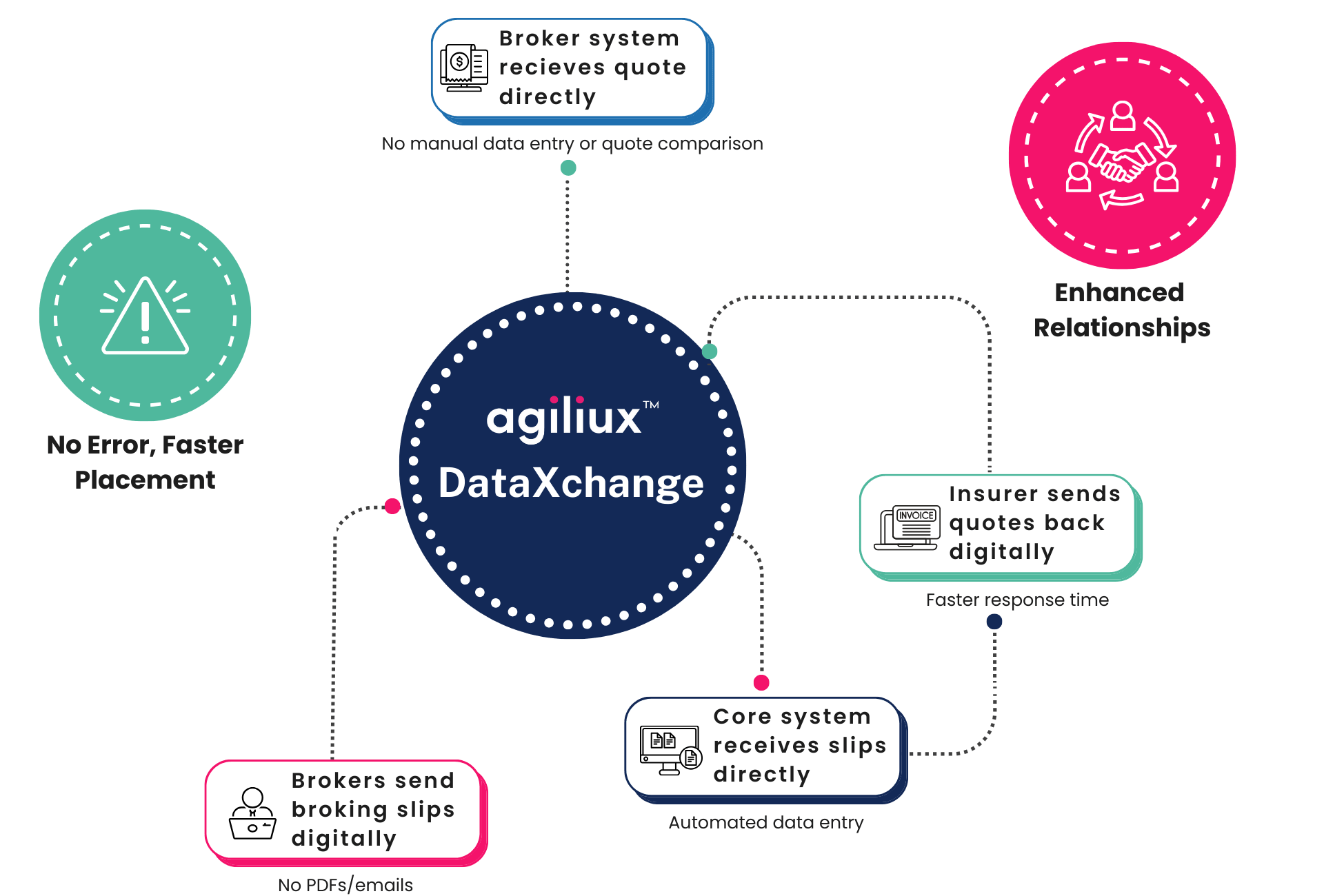

Working with Direct Insurance Brokers, for inward risk placement

Agiliux enables insurers to receive broking slips directly into their core system from brokers, eliminating the need for PDFs and manual emails. Quotes can be sent back to brokers digitally, improving response times and reducing errors.

With automated data exchange, insurers speed up risk placement, eliminate duplicate data entry, and ensure faster, more accurate underwriting decisions, enhancing broker relationships and customer experience.

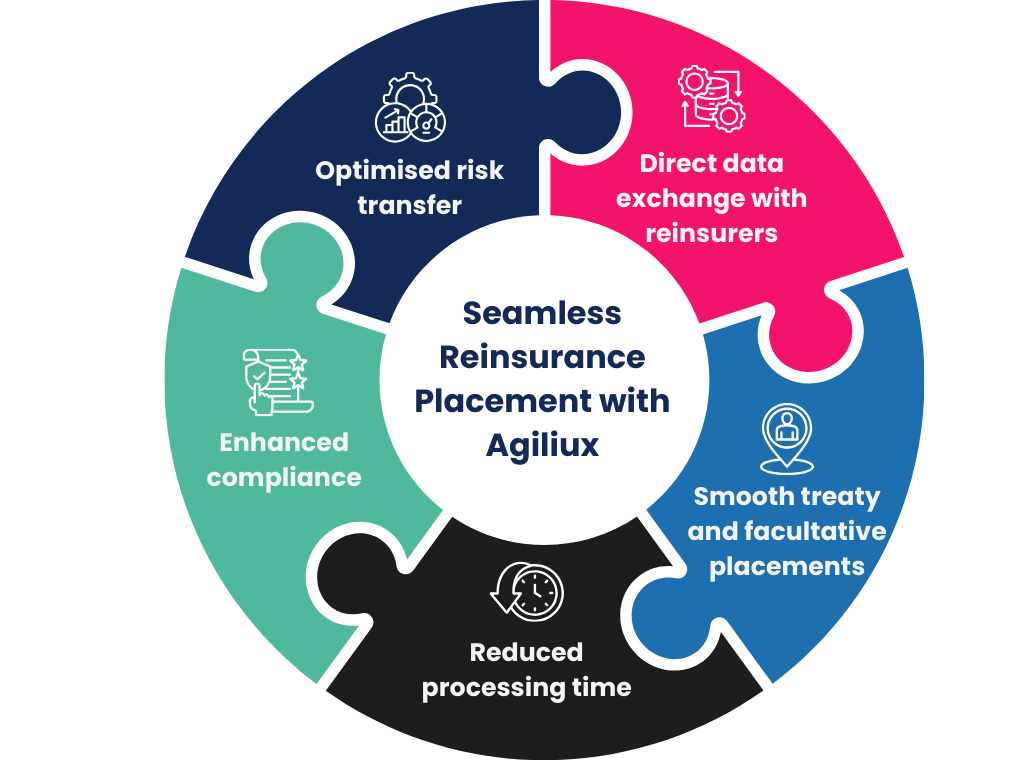

Working with Reinsurers and Reinsurance Brokers, for outward risk placement

When insurers need to cede risks, Agiliux facilitates direct data exchange with reinsurers and reinsurance brokers. RI slips, quotes, and contracts flow digitally between systems, ensuring smooth treaty and facultative placements.

This automation reduces processing time, enhances compliance, and ensures complete data accuracy throughout the reinsurance cycle. Insurers can optimise risk transfer strategies and improve collaboration with global partners.

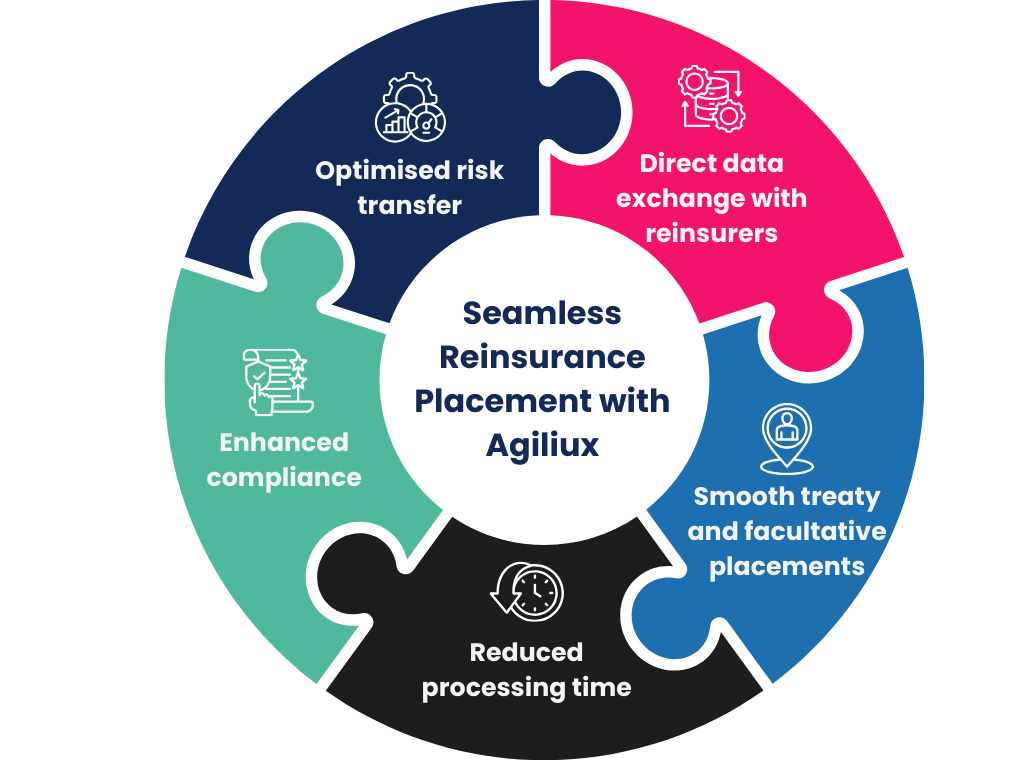

Working with Reinsurers and Reinsurance Brokers, for outward risk placement

When insurers need to cede risks, Agiliux facilitates direct data exchange with reinsurers and reinsurance brokers. RI slips, quotes, and contracts flow digitally between systems, ensuring smooth treaty and facultative placements.

This automation reduces processing time, enhances compliance, and ensures complete data accuracy throughout the reinsurance cycle. Insurers can optimise risk transfer strategies and improve collaboration with global partners.

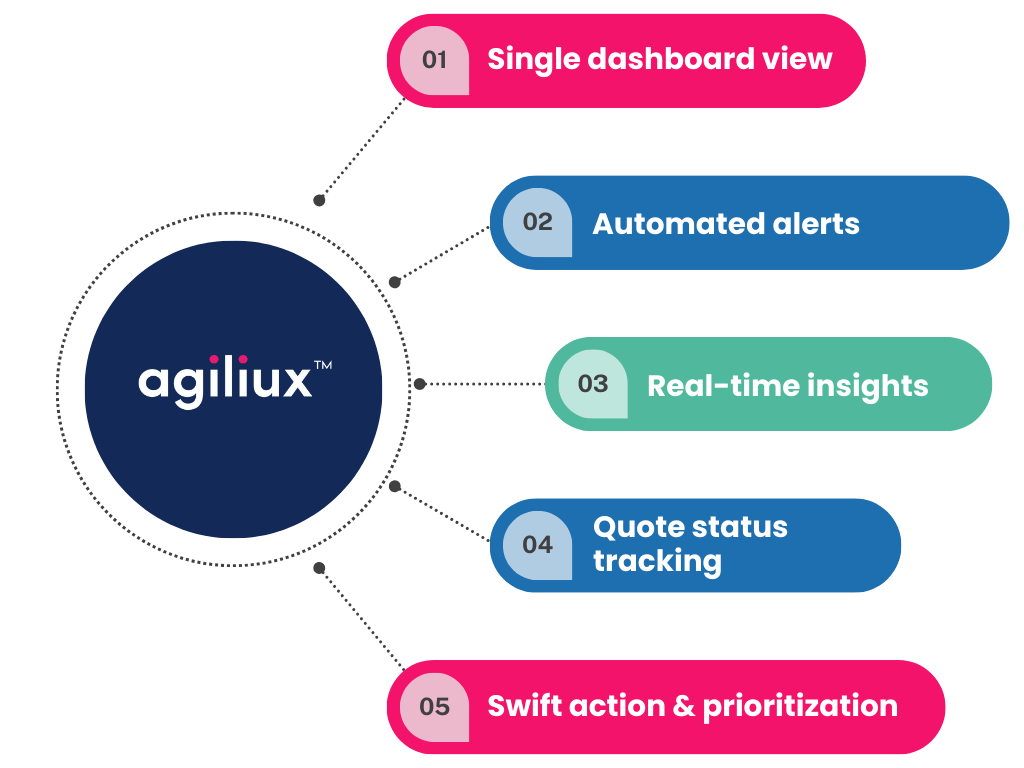

Centralised Dashboard for real-time status

Agiliux provides insurers with a centralised dashboard to track all ongoing risk placements across multiple brokers and reinsurers. Automated alerts highlight urgent tasks, reducing manual follow-ups.

With real-time insights, insurers gain full visibility into risk placements, quote statuses, and policy decisions, allowing them to act swiftly and prioritise high-value opportunities.

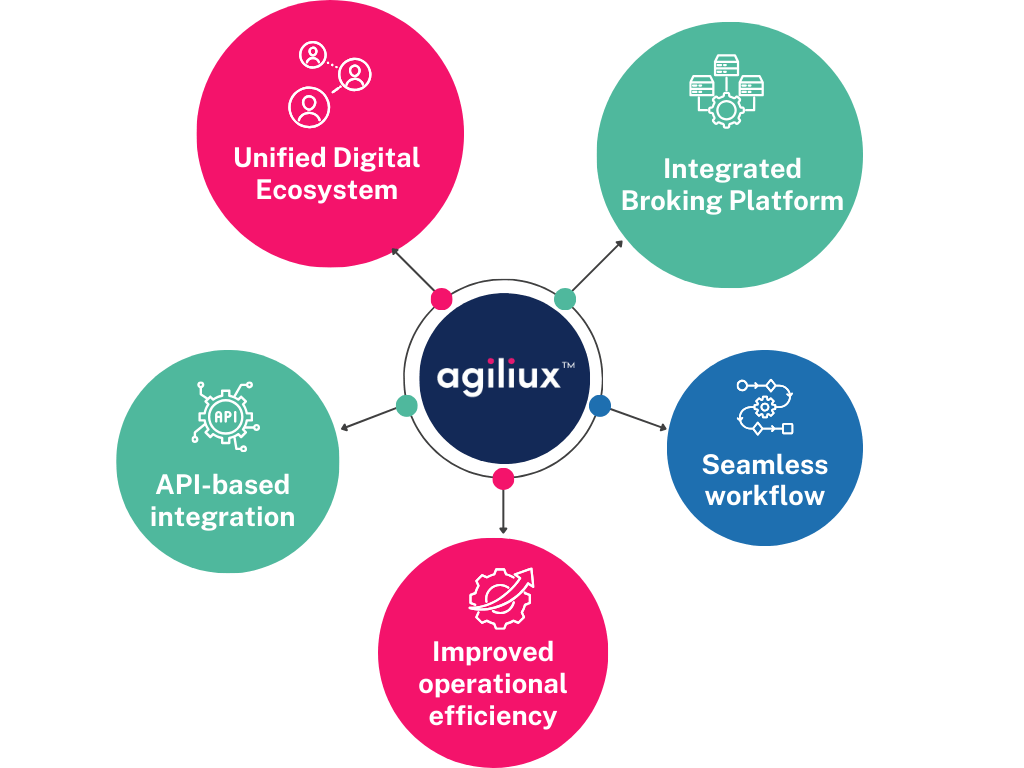

End-to-End Digitalisation of Commercial Insurance Operations

Agiliux enables insurers to achieve complete digitalisation of their commercial insurance operations by seamlessly connecting all brokers—both direct and reinsurance brokers—into a unified digital ecosystem.

For brokers without a proper system, Agiliux provides a fully integrated broking platform, pre-connected with Agiliux DataXchange, allowing them to transact digitally with insurers and reinsurers.

For brokers who already have a system in place, Agiliux offers API-based integration with Agiliux DataXchange, enabling direct, real-time data exchange between their systems and the insurer’s core platform.

With all brokers—direct and reinsurance—digitally connected, insurers benefit from a fully automated, seamless workflow across risk placement, underwriting, reinsurance cessions, billing, and claims, eliminating manual processes and improving operational efficiency.

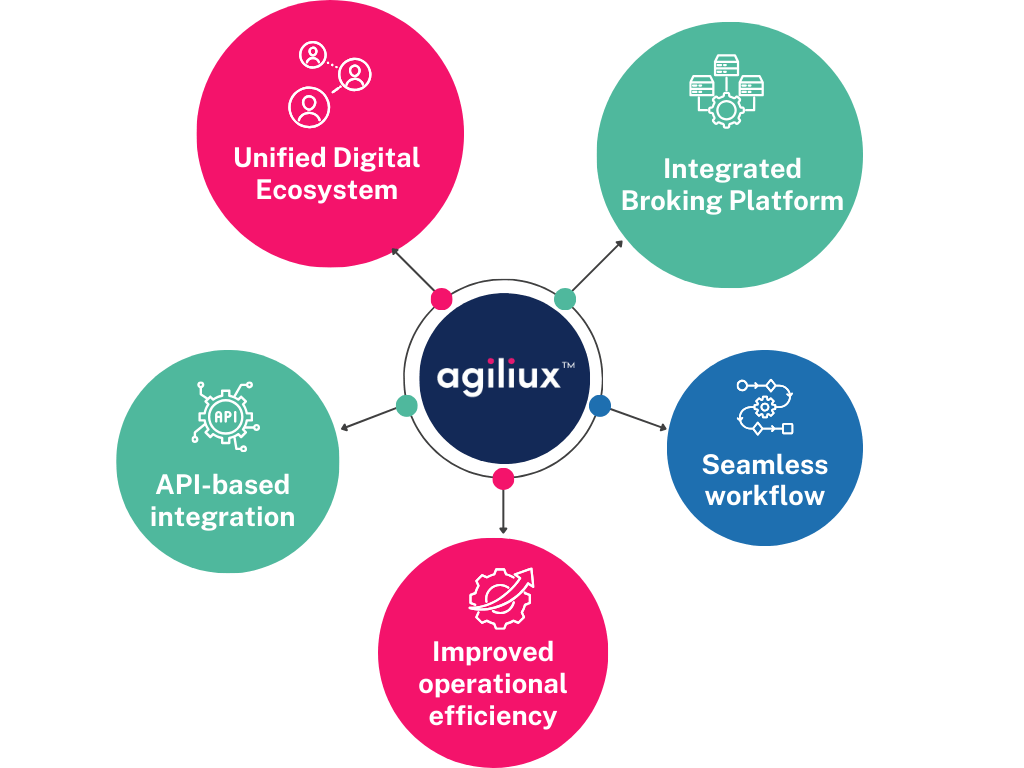

End-to-End Digitalisation of Commercial Insurance Operations

Agiliux enables insurers to achieve complete digitalisation of their commercial insurance operations by seamlessly connecting all brokers—both direct and reinsurance brokers—into a unified digital ecosystem.

For brokers without a proper system, Agiliux provides a fully integrated broking platform, pre-connected with Agiliux DataXchange, allowing them to transact digitally with insurers and reinsurers.

For brokers who already have a system in place, Agiliux offers API-based integration with Agiliux DataXchange, enabling direct, real-time data exchange between their systems and the insurer’s core platform.

With all brokers—direct and reinsurance—digitally connected, insurers benefit from a fully automated, seamless workflow across risk placement, underwriting, reinsurance cessions, billing, and claims, eliminating manual processes and improving operational efficiency.

What Makes Agiliux the Smart Choice for Global Brokers?

Learn how Agiliux supports multi-currency, multi-language, and scalable solutions, helping brokers thrive internationally.

Transform how you interact with brokers and reinsurers.

Contact us for a further discussion and implement a pilot project for Proof of Concept (POC) and see the results..