Agiliux is leading the charge in the digital transformation of the commercial insurance industry. Understanding the unique challenges faced by insurance brokers and managing general agents (MGAs), Agiliux has developed a comprehensive suite of software solutions to enhance operational efficiency, minimise errors, and improve the overall customer experience. As brokers and MGAs encounter increasing pressures to modernise, Agiliux provides an effective means of streamlining processes, ensuring these intermediaries remain competitive in a fast-evolving landscape.

Agiliux’s Vision: Transforming Commercial Insurance

The commercial insurance industry is undergoing rapid changes, driven by technology and digital innovation. Many intermediaries still rely on outdated, manual processes that introduce inefficiencies and hinder their ability to deliver exceptional service. As the sector evolves, it is vital for brokers and MGAs to embrace new technology, and Agiliux has positioned itself as a solution provider specifically tailored to meet these demands.

Agiliux is dedicated to transforming how commercial insurance intermediaries operate. The company offers solutions that streamline internal processes and facilitate more effective communication with insurers and reinsurers. Agiliux’s mission is to ensure that intermediaries are equipped with the tools they need to thrive in a digital world, enhancing insurance distribution, improving customer experiences, and enabling seamless interaction with insurers.

Tailored Solutions for the Insurance Industry

Agiliux Commercial is a complete automation platform designed for commercial insurance brokers and MGAs. It automates end-to-end processes, from handling day-to-day operations, generating business documents, and managing billing and payments, to regulatory reporting. The platform integrates all these functions into one streamlined system, eliminating bottlenecks and improving decision-making with real-time dashboards and analytics.

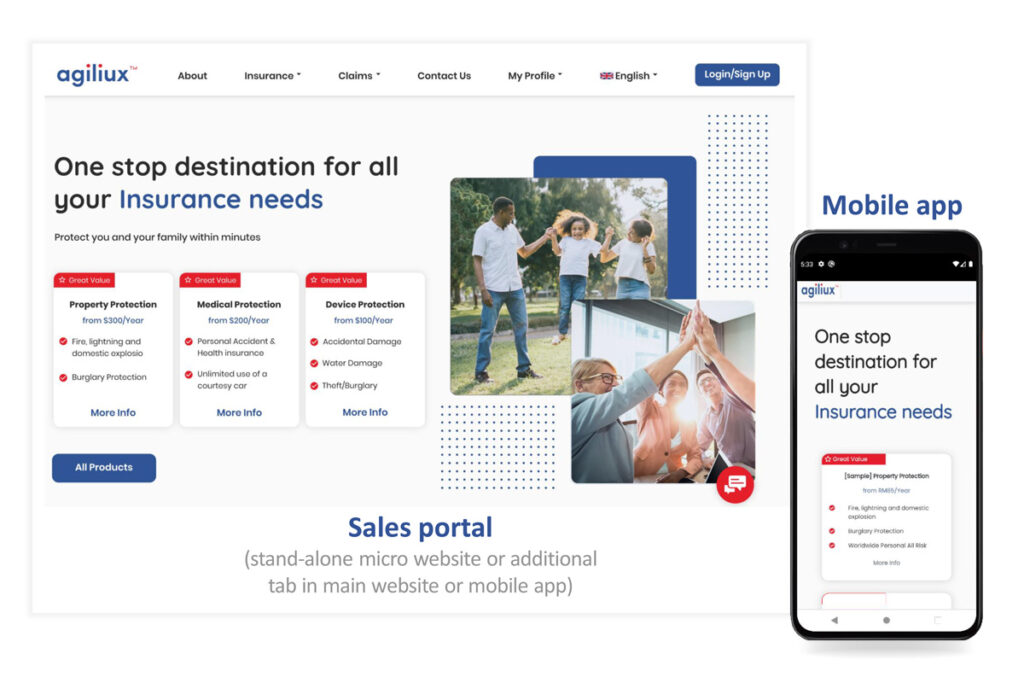

Agiliux Digital consolidates digital channels for insurers, brokers, and bancassurance, enabling efficient management of direct sales, agency portals, and embedded insurance partnerships. This platform also integrates with insurers’ APIs to provide real-time premium calculations and policy issuance, enhancing speed and accuracy. Furthermore, Agiliux Digital offers customer-facing solutions, including self-service portals and apps for policy management, claims submission, and omnichannel customer support, allowing intermediaries to build strong, long-term relationships with their clients.

Agiliux CRM provides a bespoke solution for managing sales, marketing, and customer service within the insurance sector. It covers the entire customer journey, from initial inquiries and quotations to policy issuance and claims processing. By integrating sales and service functions, Agiliux CRM helps intermediaries enhance customer interactions, streamline processes, and ensure regulatory compliance.

Modern Technology for a Changing Market

Agiliux’s key competitive advantage lies in its ability to provide fully automated, cloud-based solutions that are specifically designed for insurance intermediaries. In contrast to many legacy competitors that offer limited, accounting-focused software, Agiliux delivers comprehensive automation covering every aspect of an intermediary’s operation. The platform handles everything from inquiry management and quotations to policy and claims management, billing, and customer self-service.

Agiliux’s cloud-based system means there are no significant upfront costs for infrastructure or staffing. It is offered as a pay-per-use service, providing a flexible and cost-effective solution for mid-market brokers and MGAs. Additionally, Agiliux’s single-core system ensures seamless operations across different types of brokerages, whether in direct commercial insurance, reinsurance, or sell personal lines insurance via digital channels.

With built-in regulatory compliance across multiple countries, Agiliux also saves brokers months of compliance work, allowing them to focus on their core business activities while staying fully compliant with local regulations.

Build vs. Buy: Why Agiliux is the Smarter Choice

When deciding between building an in-house solution or buying a market-ready platform, brokers and MGAs must consider the long-term impact on their business. Building custom software can be time-consuming, costly, and require continuous updates and maintenance, all of which distract from an intermediary’s core business. Agiliux provides a ready-to-deploy solution that is continually updated and supported by industry experts, allowing brokers to benefit from its mature features immediately.

The pay-per-use model also offers scalability, meaning brokers can grow their operations without the need for large capital investments. Agiliux’s ability to scale with a business ensures that even smaller brokers can access advanced tools without incurring prohibitive costs.

Why Act Now: Maximising Long-Term ROI

In today’s fast-paced insurance environment, delaying digital transformation could result in brokers falling behind their competitors. Early adopters of digital technology are already benefiting from improved efficiencies and enhanced customer satisfaction. Agiliux offers a future-proof solution that will support brokers as they scale and adapt to evolving market conditions.

Investing in Agiliux now enables brokers to address current operational challenges and position themselves to take advantage of emerging opportunities. The insurance industry is not only evolving in terms of technology but also in customer expectations. Agiliux ensures that intermediaries can stay ahead of these changes, securing a competitive edge in the market.

Agiliux as an Industry Thought Leader

Agiliux is recognised as a thought leader in the digital transformation of the commercial insurance industry. Having expanded from its roots in Southeast Asia to more mature markets like the UK and Australia, the company is committed to reshaping the way brokers and MGAs operate globally.

Agiliux’s solutions are based on extensive research and discussions with hundreds of industry players, positioning the company as a trusted partner in helping intermediaries navigate the complexities of digital transformation. With a focus on innovation, regulatory compliance, and localised support, Agiliux is committed to driving industry-wide change and empowering brokers to remain competitive in the digital age.

Conclusion

For commercial insurance brokers and MGAs, Agiliux offers a cutting-edge platform designed to tackle today’s industry challenges. With its cloud-based solutions, comprehensive automation, and regulatory compliance, Agiliux is the ideal partner for modernising operations and driving long-term growth. Now is the time to take the next step towards revolutionising your business.

Contact Agiliux now to learn more, or schedule a meeting with one of our experts. Discover how Agiliux can transform your business operations and help you stay ahead in the evolving insurance market.