Game Changing: Claim Turns Digital

The nature of claims

Compensation is made to the policyholder in the event of a loss – is what claim is supposed to be. From the very beginning, the moment policyholder caught in the incident, and the way they hand in the evidence plays an important part in claim settlement. Many have complained that “insurance is a scammed” merely because their claims cannot be compensated. No! Throw out that kind of mindset.

There have never been in any situation where insurers do not want to pay the claim. If possible, insurers want to do. Why? Simply because of “loyalty”. “When we give more, we will get more” the concept of every insurer. However, what leads to claims to be repudiated?

Non-Disclosure of Material Facts

As a policyholder, never “not disclosed” the material facts. The action will only lead to the cancellation. As a matter of fact, the policyholder can never have his right as a claimant. This is why in insurance, the moment you entered the contract, the policyholder must practice “uberrima fides”.

The Coverage

The never-ending misunderstanding of policyholder into his policy. There is a difference when policyholder only purchases insurance plan but did not purchase the coverage. By coverage, not everything in the policy is being covered therefore, the policyholder needs to purchase additional coverage for their risk exposure to prevent from being excluded. Otherwise, the insurer will not pay for the claim.

Fraudulent Act

The act usually occurs when the claimant (policyholder) has the intention to make a profit out of his claim. Claim examiner will always careful when processing a claim as they usually appoint loss adjuster in investigating the case.

Transforming into better experience

76% out of 6, 000 insurance customers switched their insurer as they are looking for more personalized service and tailored product offerings. The survey was done and distributed by Accenture across 11 countries. The responsiveness, real-time tracking processes, and everything’s online influenced customer (policyholders) choices of insurers.

Everything’s Online

With the sudden outbreak of Covid-19 back in February 2020, people are scared to get out and have a closed contact. In addition, with the Movement Controlled Order (MCO), people cannot go out and do their businesses like usuals. Therefore, the insurance industry, the organizations or any SMEs are struggling to go online. People are hoping that there are changes made to claim management.

Real-time tracking progresses

As everything’s is going online, access to the mobile application is a must. The policyholder can submit the claim itself as there will a self-instruction provided, a platform where the policyholder can track their status and records, and/or the policyholder can make a complaint prior to service provided.

User friendly

A mobile application is one thing; however, the customer (policyholder) experience and satisfaction is the main objective. Be it any stages of age, customer want an easy, fast, and friendly mobile application that will leave a good review.

Driving into digital processes

Estimating the time taken for a claim to be settle can take up to 7 to 14 days or even a month, which depends on the case itself. The process makes claimant getting frustrated as to where the process is happening. “Has the insurers received the case?” or; “Has the insurers taken action?” the question that every claimant has every time they are waiting for the results. Therefore, the creation of Agiliux is indeed a new phase and a solution to the insurance industry. Besides, with the current situation that the world is facing, it would be more than enough of a reason why the industry should turn digital, claims should be digital.

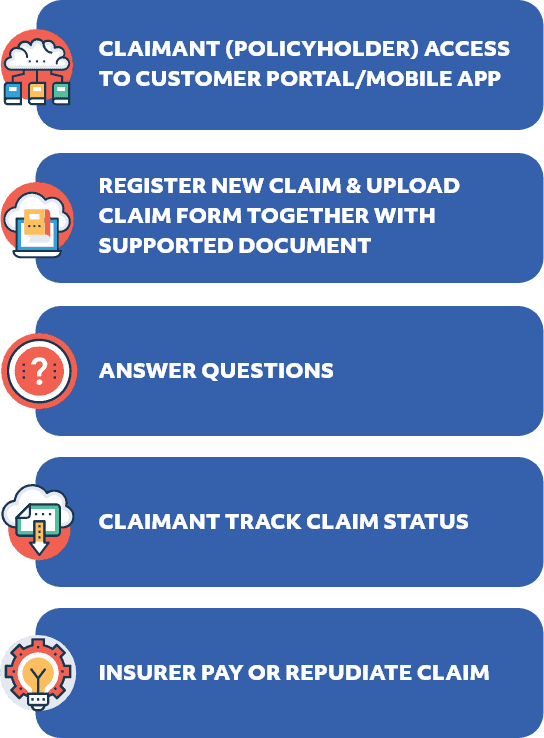

Particularly, the claims process is the same, however, the customer is our priority. We gave satisfaction to all parties, be it insurers or intermediary or the policyholder itself. Agiliux view from every aspect. Let’s take a look at how Agiliux works with claims;

Now or never – The game begins

Take a look across all countries around the world. They started to adapt to new changes, new phases of the insurance industry. They are up to the challenged and they are ready to be the market leader. Take a bold step, and be the early discovery among Asia pacific

Suggested Further Reading:

- Accenture. (2016, August). The Digital Insurance Customer Wants More Services for Less.

- DocuSign. (2020, June). The Digital Claims Imperative.

- Ehrbar, L. (2020, June). Digital Claims Automation for Customer Satisfaction, Increased Effieciency, and Fraud Prevention.

Connect with us to find out more on Agiliux and Cloud Insurance

Agiliux is a Software-as-a-Service that provides insurance professionals with an end-to-end workflow and management platform.

Agiliux Cloud Insurance:

1. A digital connectivity platform for global and regional teams with multiple currencies, tax rates, languages and regulatory requirements

2. Seamlessly connect your legacy systems to offer cutting edge digital solutions, without disrupting the existing infrastructure and processes.

3. With SaaS, upgrades are applied continuously without waiting for your IT staff and give you full value from your software investment

4. Start small with what you need and add more advanced features as you grow and ready to scale. Never pay for what you don’t use

Authored By:

| Nur Hanisah Izzul Fikri, Insurance Analyst, Agiliux | Sarabjeet Kaur, Chief Product Officer, Agiliux |

|---|---|

Authored By:

Nur Hanisah Izzul Fikri,

Insurance Analyst, Agiliux

Sarabjeet Kaur,

Chief Product Officer, Agiliux